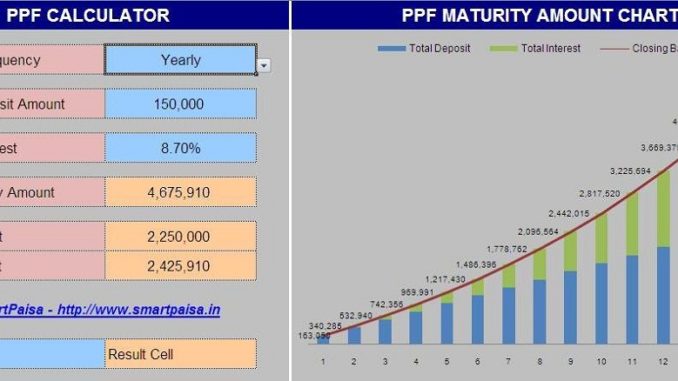

Public Provident Fund (PPF) is a savings accumulation cum tax saving scheme available for individuals. Regular deposits in PPF can be used to build sizeable savings. For example monthly deposit of Rs 10,000 in PPF account for a period of 15 years will build a corpus of approximately Rs 36 lakhs.

Use the excel based PPF Calculator to calculate maturity value of yearly or monthly investment in PPF. Also see the chart and graph of yearly accumulation of PPF balance.

Click here to download: PPF MATURITY VALUE CALCULATOR.

Applicable interest rate for Public Provident Fund is given below:

| FY | Quarter | Start Date | End Date | Interest Rate |

|---|---|---|---|---|

| FY13 | Q1 to Q4 | 1-Apr-12 | 31-Mar-13 | 8.80% |

| FY14 | Q1 to Q4 | 1-Apr-13 | 31-Mar-14 | 8.70% |

| FY15 | Q1 to Q4 | 1-Apr-14 | 31-Mar-15 | 8.70% |

| FY16 | Q1 to Q4 | 1-Apr-15 | 31-Mar-16 | 8.70% |

| FY17 | Q1 to Q2 | 1-Apr-16 | 30-Sep-16 | 8.10% |

| Q3 to Q4 | 1-Oct-16 | 31-Mar-17 | 8.00% | |

| FY18 | Q1 | 1-Apr-17 | 30-Jun-17 | 7.90% |

| Q2 to Q3 | 1-Jul-17 | 31-Dec-17 | 7.80% | |

| Q4 | 1-Jan-18 | 31-Mar-18 | 7.60% | |

| FY19 | Q1 to Q2 | 1-Apr-18 | 30-Sep-18 | 7.60% |

| Q3 to Q4 | 1-Oct-18 | 31-Mar-19 | 8.00% | |

| FY20 | Q1 | 1-Apr-19 | 30-Jun-19 | 8.00% |

| Q2 to Q4 | 1-Jul-19 | 31-Mar-20 | 7.90% | |

| FY21 | Q1 to Q4 | 1-Apr-20 | 31-Mar-21 | 7.10% |

| FY22 | Q1 to Q4 | 1-Apr-21 | 31-Mar-22 | 7.10% |

| FY23 | Q1 to Q4 | 1-Apr-22 | 31-Mar-23 | 7.10% |

| FY24 | Q1 | 1-Apr-23 | 30-Jun-23 | 7.10% |

Leave a Reply