What does Flat Interest Rate mean?

When you take Home Loan or Car Loan or Education Loan or Personal Loan or Credit Card Loan for a particular tenor, you need to not only repay the principal amount within that tenor but also pay the interest on the loan. It is important to understand interest calculation methodology. ‘X% p.a.’ Flat Interest Rate is not same as ‘X% p.a.’ Diminishing Balance Interest Rate (also referred to as Reducing Balance Interest Rate or Effective Interest Rate).

Flat Rate of Interest basically means that interest is charged on full amount of the loan throughout the entire loan tenor. Thus the Flat Rate does not take account of the fact that periodic repayments, which include both interest and principal, gradually reduce the outstanding loan amount.

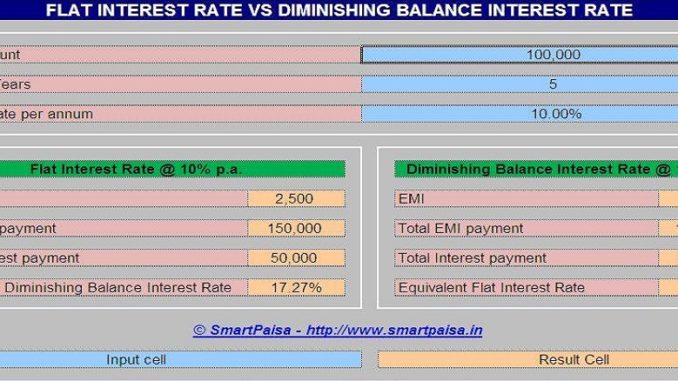

Let us understand by way of an example. For instance you take a loan of Rs 100,000 with a flat rate of interest of 10% p.a. for 5 years, then you would pay Rs 20,000 (principal repayment @ 100,000 / 5) + Rs 10,000 (interest @10% of 100,000) = Rs 30,000 every year or Rs 2,500 per month. Over the tenure of the loan, you would end up paying Rs 150,000 (2,500 * 12 * 5).

What does Diminishing Balance Interest Rate mean?

In Diminishing Balance Interest Rate method, interest is calculated every month on the outstanding loan balance as reduced by the principal repayment every month. EMI payment every month contains interest payable for the outstanding loan amount for the month plus principal repayment. On every EMI payment, outstanding loan amount reduces by the amount of principal repayment. Thus interest for next month is calculated only on the outstanding loan amount as reduced by the principal repayment this month.

For example, if instead of 10% p.a. flat rate (in the above example), interest is charged at 10% p.a. reducing balance rate, EMI amount would be Rs 2,124.70. You would pay Rs 833.33 as interest in the first month and Rs 1,291.37 (2,124.70 – 833.33) would be Principal Repayment. For next month interest will be charged only on reduced principal, i.e. 100,000 less 1,291.37 = 98,708.63. Interest for second month would be Rs 822.57 (98,708.63 * 10% / 12) and principal repayment would be Rs 1,302.13 (2,124.70 – 822.57). Thus over the tenure of the loan, you would end up paying Rs 127,482 (2,124.70 * 12 * 5).

Which is better?

Undoubtedly Diminishing Balance Interest Rate is better from the perspective that it is more transparent and signifies the “Effective Interest Rate”. Flat Interest Rate is generally misleading and is often used to entice customers with too good to resist offers. Imagine being offered 5 year loan at only 10% Interest Rate. Sounds good, but may be on little digging you realize that Interest Rate is quoted on Flat basis and the Effective Interest Rate (i.e. Diminishing Balance Interest Rate) is actually 17.27%.

Please use the below link to download excel based calculator to compute EMI for a given Interest Rate on Flat and Diminishing Balance basis. The calculator also computes equivalent Diminishing Balance Interest Rate for a given Flat Interest Rate, and vice versa.

Click here to download: FLAT INTEREST RATE VS DIMINISHING BALANCE INTEREST RATE CALCULATOR.

Thanks for sharing valuable information

Super and Nice, Thank You-

Briefed in understandable way

EXCELLENT INFORMATION

Very good clarifications from you.