Fixed Deposits as an Investment Option

Fixed Deposits have traditionally been one of the most safe investment option preferred by people with low risk appetite. Generally fixed deposits are offered by banks, but fixed deposit can also be offered by certain Non-Banking Finance Companies (NBFC) and other companies. However before putting in money in any non-bank fixed deposit, where interest rates offered are typically higher than bank fixed deposits, one should be very careful about the credit quality of the company where fixed deposit is placed.

Fixed deposit or Term deposit is a very simple investment product. As the name denotes it provides a fixed return, i.e. interest on the amount of investment. The interest is calculated and credited periodically depending on the compounding period.

What is compounding period?

Compounding period refers to the frequency with which the interest is calculated and credited to the fixed deposit amount. For example, if compounding of interest is monthly, interest for fixed deposit is calculated on a monthly basis and added to the principal amount. Thus interest for second month is calculated on the principal amount and interest for first month. Similarly interest for third month is calculated on the principal amount and interest for initial two months.

Let’s see an example to understand this better. Suppose we have to calculate maturity amount of Rs. 100,000 fixed deposit for 3 months with interest rate of 12% compounded monthly. Interest for 1st month is calculated on Rs. 100,000 at 12%, which comes to Rs. 1,000. Fixed deposit principal amount at the end of 1st month becomes Rs. 101,000. Thus interest for 2nd month is calculated on Rs. 101,000, which comes to Rs. 1,010. Similarly interest for 3rd month is calculated on Rs. 102,010, which comes to Rs. 1,020.10. Thus maturity amount for 3 month deposit comes to Rs. 103,030.10.

Why is compounding period important?

This question is best answered by adding a variation to the previous example. Suppose in the example above, instead of interest being compounded monthly, it is compounded on a quarterly basis, let’s see the impact on final maturity value of the fixed deposit. Interest for 3 months comes to Rs. 3,000 and final maturity value of fixed deposit is Rs. 103,000. Note the final maturity value has declined when the compounding period has been increased. Thus we can say shorter the compounding period, higher is the effective return on fixed deposit. Reason is simple and intuitive. Shorter compounding period means interest on fixed deposit is calculated more frequently and added to the outstanding principal amount for the purpose of interest calculation for the next compounding period. This translates into more interest income on interest, which effectively is the essence of compounding.

Note that in India, interest on bank fixed deposits is normally compounded on a quarterly basis.

Fixed Deposit as Tax Saving Investment option

Investment in Fixed deposits with scheduled bank for minimum tenor of 5 years qualifies for deduction under Section 80C.

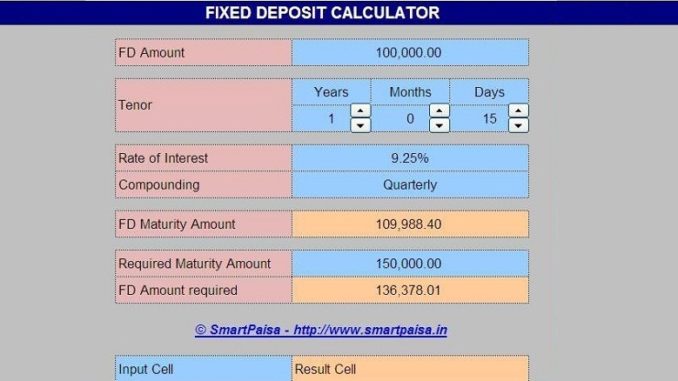

Fixed Deposit Maturity Value Calculator

Use the Fixed Deposit Maturity Value Calculator for calculating the maturity amount of Fixed Deposit under various compounding options, viz. Yearly, Half-yearly, Quarterly, Monthly, Daily and without any compounding. In the calculator, Interest payment has been assumed on cumulative basis, i.e. on maturity.

You can also use the Calculator to compute the Fixed Deposit amount required to be done to get desired maturity amount.

Click here to download: FIXED DEPOSIT MATURITY VALUE CALCULATOR.

Leave a Reply