Who is a Non-Resident Indian?

An Indian abroad is popularly known as Non-Resident Indian (NRI). NRI is legally defined under the Income Tax Act, 1961 and the Foreign Exchange Management Act, 1999 (FEMA) for applicability of respective laws.

Difference between Resident definition under Income Tax and FEMA

- “Financial Year” is not defined under FEMA, but by convention it is assumed to refer to 1st April to 31st March

- Income-tax Act requires physical presence of 182 days or more, whereas, FEMA requires 183 days or more

- Income-tax Act considers the physical presence of a person in the Current Financial Year, whereas FEMA considers physical presence of a person in the Preceding Financial Year

NRI as per FEMA

NRI is defined under FEMA as a person resident outside India who is either a citizen of India or is a Person of Indian Origin (PIO).

PIO means a citizen of any country other than Bangladesh or Pakistan,

- who at any time held Indian Passport, or

- who or either of whose parents or any of the grand parents was a citizen of India under Constitution of India or under Indian Citizenship Act, 1955, or

- who is spouse of an Indian citizen or spouse of person referred to in 1 and 2 above

“Person resident outside India” is defined indirectly to mean a person who is not resident in India. “Person resident in India” is a person residing in India for more than 182 days in the Preceding Financial Year. Preceding Financial Year means the financial year, which ended on the last 31st of March. Thus for example, as on 11th June 2007, the Preceding Financial Year would be “2006-07”. FEMA also excludes person moving out of India for employment or business from category of Resident. Similarly it also excludes a person coming as tourist / visitor from the category of Resident. Let’s see the detailed definition below:

“Person resident in India” means:

1. Person Resident in India for more than 182 days during the course of Preceding Financial Year but excludes :

(a) A person who has gone out of India or who stays outside India :

i. for employment outside India; or

ii. for carrying on a business or vocation outside India; or

iii. for any other purpose, in such circumstances as would indicate his intention to stay outside India for an uncertain period.

(b) A person who has come to India or stays in India for any purpose other than :

i. for employment in India, or

ii. for carrying a business or vocation in India, or

iii. for any other purpose, in such circumstances as would indicate his intention to stay in India for an uncertain period;

2. Any person or body corporate registered or incorporated in India;

3. An Office, Branch or Agency in India owned or controlled by a person resident outside India;

4. An Office, Branch or Agency in India owned or controlled by a person resident in India.

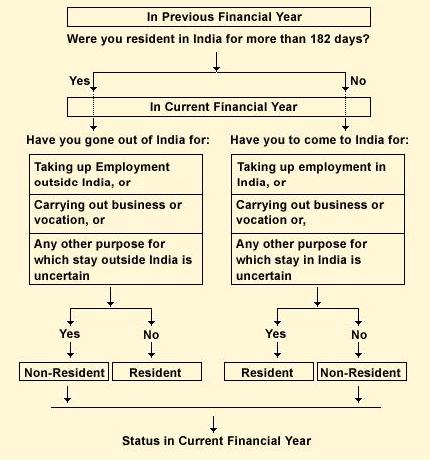

The definition under FEMA is explained in simple terms for individuals hereunder.

- The residential status of a person leaving India shall be determined as follows: If a person leaves India for the purpose of employment, business or for any other purpose that indicates his intention to stay outside India for an uncertain period, then he becomes a non-resident from the day he leaves India for such purpose.

- The residential status of a person returning to India will be determined us follows: If a person comes to India for the purpose of employment, business or for any other purpose that indicates his intention to stay in India for an uncertain period; then he becomes a resident from the day he comes to India for such purpose.

As per the definition there is also a requirement of physical stay for more than 182 days in India in the Preceding Financial Year. But there is some confusion whether this requirement is necessary condition for being classified as Resident. Important to see extract of FAQ given on RBI website:

“Q.53. What is meant by a person resident in India?

A.53. From FEMA angle, a person resident in India means a person residing in India for more than one hundred and eighty-two days during the course of the preceding financial year (April-March) and who has come to or stays in India either for taking up employment, carrying on business or vocation in India or for any other purpose, that would indicate his intention to stay in India for an uncertain period. In other words, to be treated as ‘a person resident in India’, under FEMA a person has not only to satisfy the condition of the period of stay (being more than 182 days during the course of the preceding financial year) but has also to comply with the condition of the purpose/intention of stay.”

If we take the interpretation of above (although FAQ cannot be regarded as rule of law), it would appear that a resident is a person who:

- Spends more than 182 days in India during the Preceding Financial Year AND

- Does not fall in either (a) or (b) in the definition above.

Point (a) excludes from the definition of FEMA resident those who meet (1) and then go abroad for an indefinite period, say for employment. Point (b) excludes from the definition of FEMA resident those who meet (1), but have come to India as visitors/ tourists to India with a definite plan to return abroad.

However the above interpretation doesn’t seem to logically gel with the intent of the legislation and also the definition of “Person Resident in India” as given under erstwhile FERA. Let us consider a person who returns to India on 1st Nov 2008 to retire and live in India for an indefinite period. In the Preceding Financial Year, i.e. period from 1st April 2007 to 31st March 2008, he was not present in India for 183 days. Hence he would be classified as Non-Resident even though he should be classified as Resident as per clause (b) in the definition, since he has returned to India to stay for an uncertain period. Going by the earlier interpretation, he would be classified as Resident only from 1st April 2010, since on that day he would satisfy the condition of 183 day stay in India in the Preceding Financial Year, i.e. period from 1st April 2008 to 31st March 2009. This definitely is not the intent of the clause since a person should actually be classified as Resident from the day he returns to India to stay for an uncertain period.

Thus in order to make a definition of a person resident in India workable one has to look first at the exceptions given in clauses (a) and (b) and if the person is not falling under either of them, then look at his physical presence in India during the preceding financial year. The flowchart provides a good basis to determine Residency status of a person under FEMA.

Leave a Reply